In the complex web of running a small business, the bookkeeper often plays a key role in maintaining its success and financial stability. Even while the word "bookkeeper" may bring up ideas of someone meticulously adding up numbers, their job entails much more.

In this article, we'll examine the purpose of a bookkeeper in a small business. We'll discuss their duties and how they contribute to the enterprise's financial health.

1. Keeping Accurate Financial Records

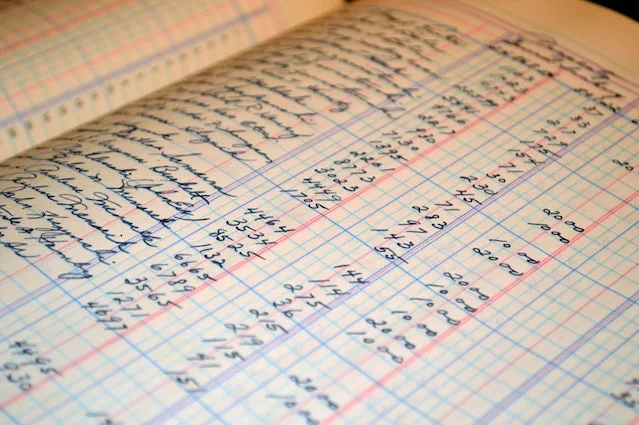

The major duty of a bookkeeper is to keep complete and accurate financial records for a small firm. Financial transactions such as sales, purchases, receipts, and payments must be precisely recorded to do this. Bookkeepers give business owners the ability to track the financial health of their enterprise by maintaining a thorough and structured record of these transactions.

Aside from aiding decision-making, accurate financial records also provide crucial data for tax compliance and financial reporting.

2. Controlling Accounts Payable and Receivable

Besides maintaining records, bookkeepers manage a small business's accounts receivable and payable. They ensure that invoices are sent out to clients and customers on time, keep track of payment deadlines, and pursue any late payments. Regarding accounts payable, bookkeepers manage vendor invoices, compare them to purchase orders, and schedule prompt payments.

With this, bookkeepers help businesses maintain healthy cash flow management and reduce the risk of financial hardship. They even promote good relationships with customers and suppliers.

3. Decision-Making and Financial Analysis Become Easier

Another purpose of a bookkeeper in a small business is to make decision-making easier. Bookkeepers give small business owners invaluable financial information, enabling them to make wise decisions. They aid in the identification of trends, the tracking of expenses, and the evaluation of profitability by analyzing financial data and producing reports.

Also, they can develop financial ratios and key performance indicators (KPIs) that act as standards for the organization's performance. With this knowledge, business leaders may spot areas for development, allocate resources wisely, and make wise strategic choices that will promote expansion and profitability.

4. Helping with Tax Compliance

For small business owners, navigating the intricate world of tax compliance can be difficult. But bookkeepers ensure the timely and accurate processing of paperwork connected to taxes. They keep track of tax-deductible costs, reconcile financial records, and supply the data required for tax filing.

Bookkeepers can collaborate closely with tax experts to ensure adherence to tax laws. They can also reduce the possibility of fines or audits. Hence, business owners can have peace of mind and concentrate on other facets of their operation.

Conclusion

A capable bookkeeper is a crucial component of every small firm. Their meticulous attention to detail, financial knowledge, and dedication to keeping accurate records all contribute to the success of firms. Any small business that wants to be financially successful should embrace the function of a bookkeeper.

Sodiq J.

Sodiq J.